State and Explain the Different Components of Money Supply

It is determined by the uses to which certain physical and financial assets are put. Before explaining these two components of money supply two things must be noted with regard to the money supply in the economy.

Demand deposits with the public.

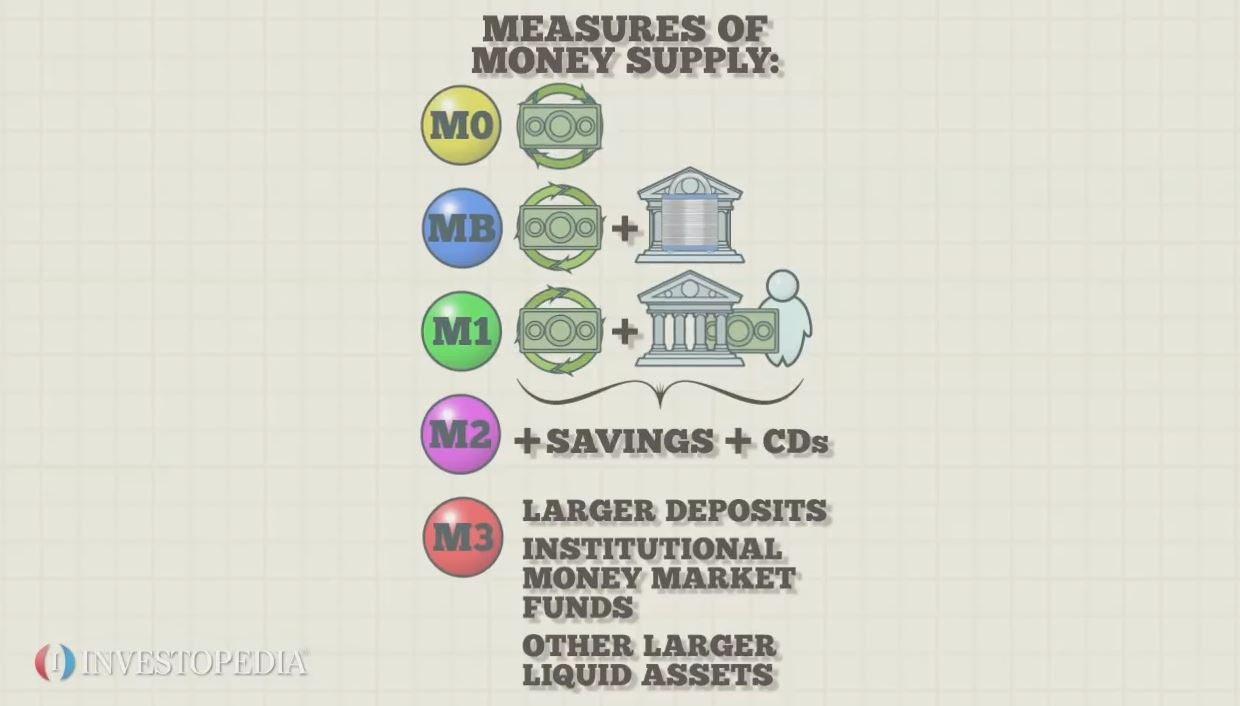

. It includes a Currency notes in circulation issued by the Reserve Bank of India. We can define the money supply in three different ways - M1 M2 and M3. Currency includes all coins and paper money issued by the government and the banks.

It refers to currency held by public in terms of coins and paper notes. It consists of paper notes and coins held by the public. Money supply in three different ways.

Definition of supply of money varies depending on the components which are included and excluded. Therefore any investigation of the money. Every measurement has it own definition with different components varying from most liquid to most rigid form.

Money supply consists of various components as follows. The non-bank deposits with a commercial bank. C Small coins in circulation.

M2 includes everything in M1 as well as savings deposits time deposits below USD 100000 and balances in retail money market funds. The supply of money is made up of two components. B The number of rupee notes and coins in circulation.

A Currency C including. This component of money supply refers to. This is the broadest.

Currency component - It includes currency notes and coins collectively called the currency component of money supply. The fourth measure of money supply is M 4 which consists of M 3 plus total post office deposits comprising time deposits and demand deposits as well. The other important components of money supply are demand deposits of the public with the banks.

That is money supply is a stock concept in sharp contrast to the national income which is a flow representing the value of goods and services produced per unit of time usually taken as a year. The money supply is the total amount of money currencydeposit money present in an economy at a particular point in time. Currency and demand deposits held by banks.

The Federal Reserve measures the US. RBI calls M 3 as broad money. The money supply is the stock of money in the economy.

The effective money supply consists mostly of currency and demand deposits. M1 consists of coins and currency in circulation checking accounts and travelers. Bank deposits payable on demand are regarded part of money supply and they constitute about 75 to 80 per cent of the total money supply in the US.

Remember any currency held with the government and banks is. M 1 is the most liquid measure of money supply as all its components are easily used as a medium of exchange. The following are the components of money supply.

M1 is the narrowest definition of money. The following are the components of money. The change in the supply of money in an economy can affect the price level of.

Monetary base M1 and M2. Currency such as notes and coins with the people 2. M1 C DD OD.

Money supply includes deposits generated in the banking system resulting from a multiplier effect of movement of currency in the banking system as well as other forms of liquid assets. Components of money supply 1. You might have heard about the M1 M2 M3 and M4 components of the money supply.

The third measure of money supply in India is M 3 which consists of M l plus time deposits with commercial and cooperative banks excluding inter-bank time deposits. In those cultures the shells thus used would have formed part of the money supply. This includes all types of currency notes and coins that a person keeps in his pocket or at home in order to meet their daily needs.

The currency is manufactured in two forms. Rather you dont have to right its name also M1 M2 M3 and M4. Money supply is measured in several ways which includes M1 M2 M3 and M4 measurement of money supply.

For example in many cultures in the past shells have been used as money. The two components of Money Supply are Currencyand Demand Deposits. The components of the money supply are.

But wait As per the syllabus of class 12 CBSE Board. M1 includes all currency in circulation travelers checks demand deposits at commercial banks held by the public and other checkable deposits. Money supply refers to the amount of money available to a countrys population as well as the amount of money that can be included in the countrys economy.

Demand deposits with the banks such as savings and current account 3. The record of the total money supply is kept by the Central Bank of the country. Deposit component - It includes the savings or the current account deposits held.

Monetary base is the sum of currency in circulation and reserve balances ie deposits held by banks and other depository institutions in their accounts at the Federal Reserve. We will study only the most common and basic measure of it. 4 Most Important Components of Money Supply Lay Down by the Reserve Bank of India 1.

Currency and coins with the public. Currency and coins with Public. The money supply refers to the amount of cash or currency circulating in an economy.

You dont have to memorize all components of it. There are three measures of money supply M1 M2 and M3. Money supply consists of.

M1 Component of Money Supply. First the money supply refers to the total sum of money available to the public in the economy at a point of time. Paper cash and coins.

Total currency circulating in the public plus. In brief money supply is the stock of money in a particular periodThus two component of money supply are A currency Paper notes and coins. First the money supply refers to the total sum of money available to the public in the economy at a point of time.

B Demand deposits of commercial banks. M2 Component of Money Supply. Currency with the public 2.

Different measures of money supply take into account non-cash items like credit and loans as well. Currency demand and time deposits in commercial banks and other types of deposits are the total amount of money in an economy. The standard measures to define money usually include currency in circulation and demand deposits.

This component of money supply is devised to. Time deposit with the bank such as Fixed deposit and recurring deposit.

Management Infographic Infographic Supply Chain Management

The Five Components Of Supply Chain Management

The Mom S Guide Of Supply Chain Management For Ecommerce Success The Mom Kind Supply Chain Management Supply Chain Management Business Supply Chain Logistics

/money--money--money-3429418-a99756eabdfe4e8aab5417684056dea3.jpg)

No comments for "State and Explain the Different Components of Money Supply"

Post a Comment