Describe Accounting Ratios Managers Could Use

The limitations of ratio analysis include the inability for comparisons to be made across industries due to the fact that acceptable ratios vary by. Managers need to allocate the financial human and capital resources towards competing needs of the business through the budgeting process.

Financial Ratios Balance Sheet Accountingcoach Financial Ratio Accounting And Finance Accounting

Financial ratios are important metrics for analyzing a companys finances.

. Determine the fractions that are used to calculate each partners share of net income or net loss. On Dixons last property tax bil Kelton Co which produces and sells skiing equipment is financed as follows. While the companys managers are familiar with the concept of spending vari.

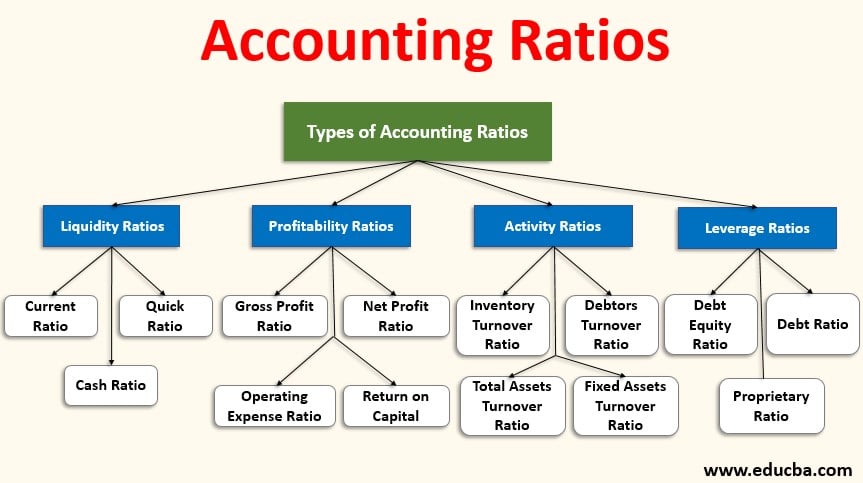

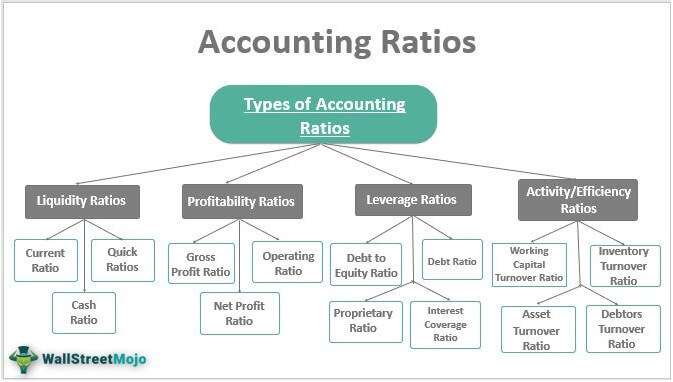

Essentials of Cost Accounting for Health Care Organizations Finkler 1994 23. Liquidity ratios Operational Risk ratios Profitability ratios. Log In Sign.

Likewise banks also use various ratios to measure a companys financial health. Full PDF Package Download Full PDF Package. Download Full PDF Package.

Discussions about creating a common set of. What if 2 companies have the same value of PE ratios which company does you think is better. It measures the performance of an investment against a market index benchmark that represents the market movement as a whole.

The stock had a fair market value of 18 per share on this date. Under accrual basis accounting transactions are generally recorded in the financial statement when the transactions occur and not when paid although in some situations the two events could happen on the same day. Describe the finance functions within a company and where you see yourself fitting.

In rating or stock analyst reports we will find various ratios. In this article I will describe various financial ratios including. 7 Full PDFs related to this paper.

How would you forecast the future. Managers need accounting information to plan monitor and make business decisions. What is our companys stock price.

This type of accounting is permitted for nonprofit entities and small businesses that elect to use this type of accounting. The alpha shows the performance of the investment after its risk is considered. Corporate Finance Ratios are also heavily used by financial managers and C-suite officers to get a better understanding of how their business is performing.

Managers of a revenue center are responsible for both revenues and expenses of that unit Intensive Care Unit Managers of a cost center are responsible for only the expenses of the unit Finance department Source. In addition tax regulations and. Ratios provide them with a guide for drawing conclusions from the analysis they perform.

Enter the email address you signed up with and well email you a reset link. Looking at the tax return alone one could compare to the accounting earnings for the entities included in the tax return via the schedule M-1 or M-3 but again if one is interested in benchmarking to accounting earnings for some certain group of entities the consolidated set for GAAP then this approach may not provide the solution. Use the form provided in your working papers.

On June 1 Mason Company issued 8000 shares of its 10 par common stock to Dixon for a tract of land. This helps with trend analysis of a company and also provides a way to compare companies of different sizes. This type of accounting is permitted for nonprofit entities and small businesses that elect to use this type of accounting.

FINANCIAL ACCOUNTING STUDY TEXT CPA SECTION 1. Risk-Adjusted Return Ratios Jensens Alpha. A short summary of this paper.

Types of Corporate Finance Ratios Corporate Finance Ratios can be broken down into four categories that measure different types of financial metrics for a business. Close Log In. MANAGEMENT ACCOUNTING STUDY NOTES.

How would you explain net present value to non-finance major. Remember me on this computer. Jensens Alpha is used to describe the active return on an investment.

Whats a PriceEarning PE ratio and how do you use it. Department is often used to describe either a cost center or a revenue center. Log in with Facebook Log in with Google.

For many years the ability to compare financial statements and financial ratios of a company headquartered in the United States with a similar company headquartered in another country such as Japan was challenging and only those educated in the accounting rules of both countries could easily handle the comparison. Under accrual basis accounting transactions are generally recorded in the financial statement when the transactions occur and not when paid although in some situations the two events could happen on the same day. The use of accounting ratios is useful because it provides a quick summary of financial statements.

Click here to sign up. Preparing and monitoring budgets effectively requires reliable accounting data relating to the various activities processes products services. Following are the ratios used by several partnerships to divide net income or net loss.

What Are Financial Ratios Definition And Meaning Market Business News Financial Ratio Money Management Advice Accounting And Finance

No comments for "Describe Accounting Ratios Managers Could Use"

Post a Comment